News

Latest News

REIA Releases Housing Affordability Report

by Rebecca Day in Latest News

The Real Estate Institute of Australia have released their 'Housing Affordability Report' June Qtr 2023.

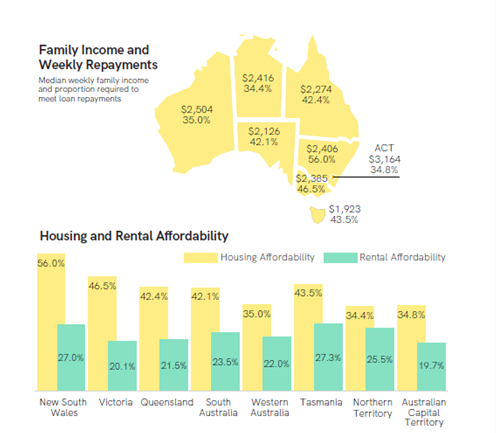

As summarised by REIA it is no surprise that housing affordability across the nation has declined, reporting that the proportion of income required to meet the average loan repayment across Australia is now 45.9%. This is slightly higher than South Australia on 42.4%.

Housing

- The proportion of income required to meet the average loan repayment increased by a slight 0.9 percentage points to 45.9%.

- Housing affordability for mortgage holders declined everywhere except Victoria.

- Mortgage affordability is the highest is New South Wales at 56%, followed by Victoria (46.5%), Tasmania (43.5%), Queensland (42.4%), South Australia (42.4%), Western Australia (35%), ACT (34.8%) and the Northern Territory (34.4%).

Rents

The proportion of income required to meet median rent increased a fractional 0.4 percentage points to 23.34 and an annual decline of .4 percentage points.

Tasmania remains the most unaffordable state to rent at with the rent-to-income ratio sitting at 27.3%, followed by New South Wales (27%), Northern Territory (25.5%), South Australia (23.5%), Queensland (21.5%), Western Australia (22%), Victoria (20.1%) and the ACT (19.7%).

At Trove it is common to see applications vastly exceeding the affordability criteria of 35%, making it exceptionally difficult for tenants to live day to day as their disposable income has dramatically reduced with rent increases.

Average weekly rents in the suburb of Aldinga Beach have increased from $330 for a 3 bed, 1 bath house to an average of $440 over the last 18 months which is a whopping $5720 in rent per year.

Relatively mortgage repayments on $350,000 loan where the interest rate has increased from 2.5% to 6.5% have also skyrocketed by an additional $14,000 per annum or $269 per week!