News

Latest News

5 Things to Consider Before Selling Your Investment Property

by Linda MacNab in Latest News

If you own an investment property, you may be considering selling it to cash in on the recent gains to property prices, however, before you put your property on the market, it's important to be informed and weigh up all the options to ensure this is the best step for you. Below are 5 important things to consider before you sell your investment property.

What are your investment goals?

When you first purchased your investment property, you likely had a long-term investment goal in mind. Whether it was to generate passive income or build long-term wealth, it's important to consider whether selling your property aligns with your overall investment strategy. Some fundamental reasons to invest may have been

- To provide for your family’s future and build an investment nest egg to support your retirement.

- To reduce the amount of tax that you pay.

- To assist your children to get into home ownership.

Correctly structured, well managed property is a proven and tested way to meet all the above objectives. Have your objectives changed?

Investing in property is a long term plan

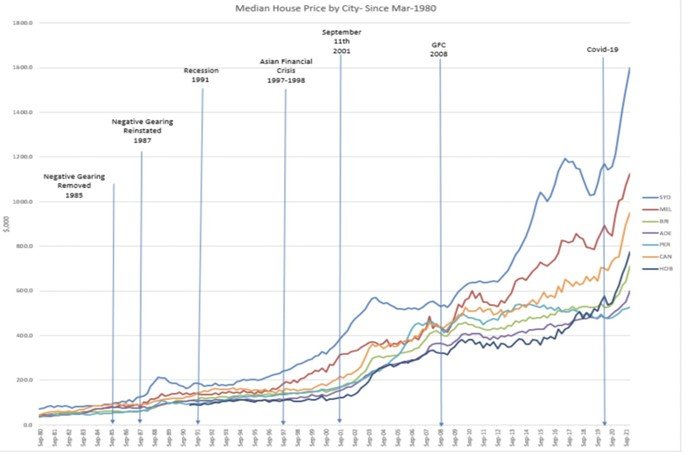

Property prices in Australia can typically be viewed in cycles. Historically property prices have increased over time however these increases are typically unpredictable and inconsistent. For this reason, the length of time that you hold a property as an investment is critically important. History shows that if you are able to hold a property through multiple property cycles you should do very well.

Given property investment provides returns over the long haul, it is best to hold onto your asset unless you absolutely can not, or if the equity can be used elsewhere for a superior return.

The below chart shows the increase in house prices over time across Australia.

Tax implications

Selling your investment property may have significant tax implications which catches many people unaware. When you sell your investment property you must determine if you have made a capital gain or loss. If you have made a capital gain, you are responsible for paying Capital Gains Tax which can take a very large chunk of your sale proceeds. The 'Capital Gain' will be added to your taxable income in the financial year that you sell the property. This means that if the gain pushes you into a higher tax bracket, you may end up paying a higher rate of tax on your other income as well. Before making a decision, it's important to consider the potential tax consequences and whether it may be more advantageous to hold onto the property and continue generating rental income.

How much is your property really costing you?

One of the great reasons to invest in property is that you have 2 partners helping to cover the cost of ongoing ownership. The rental income and the tax benefits.

By ensuring your investment property is

- Correctly structured with ownership and the right finance

- Ensuring you are taking full advantage of property investment tax deductions

- Your Property Manager is maximising rental returns

Owning an investment property is very affordable. The longer you hold your property the more affordable it generally becomes. Investing in property can also assist in reducing non-taxable debt (i.e. your home loan).

How will you use the sale proceeds?

Remember the reasons that you chose to invest in property in the first instance. Have these changed?

Investing is property has proven time over that it is one of the best ways to develop and hold wealth. The power of capital growth coupled with the tax benefits and strong rental yields that can be achieved through investing in South Australian property can be a low risk, affordable and effective way to grow your nest egg. If you were to sell your investment property, how will you use or allocate the proceeds to ensure that you are still maximising your potential investment returns.

If you are considering selling your investment property, we encourage you to seek financial advice first to fully understand the cost/benefit. Feel free to contact me also. With over 10 years as the Director of a Finance company before moving to Team Trove I am here to help. You can reach me on 0402 240 094.