News

Latest News

THE RETREAT OF PROPERTY INVESTORS

by Rebecca Day in Latest News

How the retreat of property investors across Australia is impacting rents across the country

RP Data Core Logic recently published an eye opening article on "The Retreat of Property Investors: which State has been most impacted?"

The article stated investor activity in the Australian Housing Market has been slowly falling since 2015, primarily after policies were implemented that impacted Australian mortgage lending.

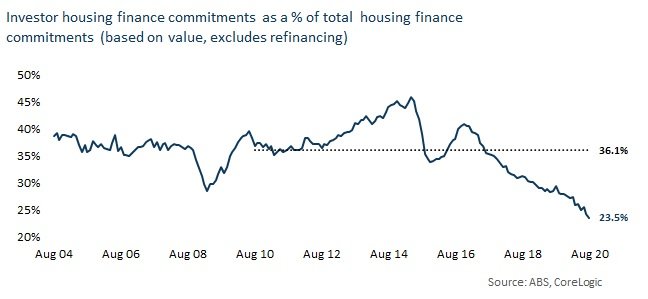

The latest ABS housing finance data shows the portion of housing finance for the purchase of property lent to investors fell to a record low of 23.5% in August. This is significantly lower than the decade average of 36.1%. As the number of investors moving into the market drops, so does supply. Demand for rentals in SA, particularly in suburban areas is far greater than supply, causing anguish and frustration amongst tenants searching for a home. When demand is greater than supply, prices are pushed upwards.

Other factors impacting the retreat of investors;

- mortgage rate premiums for investor loans

- less appetitive for high LVR and interest only lending from the banking sector

- less certainty around prospects for capital gains

- high levels of housing construction which have softened rental returns

- the recent global pandemic, which has created a particular negative demand shock to some rental markets

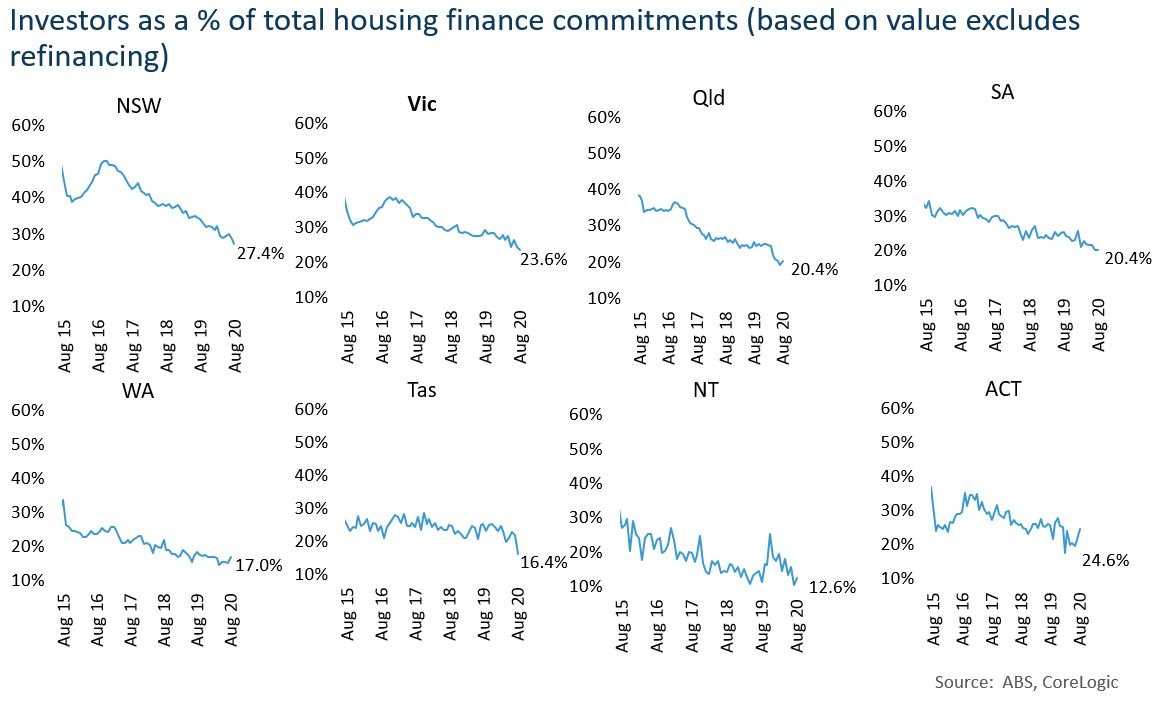

Interestingly, when looking at a State by State breakdown South Australia's portion of investor finance is even lower than the national average at only 20.4%, however significantly higher than some states.

When comparing investor activity by States, SA has faired better than its counterparts in NT, Tas and WA. It has also seen a positive growth overall in rental values at 2.6%, above inflation. These factors coupled with record low mortgage rates, low dwelling prices and a tightening rental market which will see rental values continue to increase may see investors look to SA in the coming quarters.

Here at Trove we experiencing large volumes of investors looking to leave the market. With this data to hand, hanging on to your investment may be the better option, particularly as finance markets have improved considerably with brokers having access to more favourable investor lending. If you would like a free review on your investment, feel free to contact Amee or Bec on 8386 1555.

To read the full RP Data CoreLogic Article, click here.