News

Latest News

Old or new, depreciation will benefit you.

by Rebecca Day in Latest News

Depreciation comparisons for old and new homes

One of the most common mistakes made by investment property owners is to assume that because their property was constructed some time ago, there will be no depreciation benefits available.

It’s an age old myth perpetuated by the fact that legislation does outline restrictions based on the construction commencement date for capital works deductions.

While legislation does state that the capital works component of a property can only be claimed on properties where construction commenced after the 15th of September 1987, this is not the only component of the property to which depreciation applies.

Let’s take a closer look at the two main elements that are considered when calculating depreciation; capital works deductions and plant and equipment.

Capital works deductions

The capital works component of a property refers to the building structure and any fixed irremovable items. Some examples of items which will be classified as capital works when calculating depreciation deductions are the walls, floors, windows, doors, the roof, bath tubs, kitchen cabinets and outdoor decking.

Depreciation for structural items is calculated at a rate of 2.5 per cent per year for forty years from the construction commencement date so long as construction commenced after the 15th of September 1987. However, properties constructed prior to 1987 have often undergone some form of renovation. Owners of older properties may find that they are still entitled to capital works deductions for renovations completed within the legislated dates, even if they were completed by a previous owner of the property.

Plant and equipment assets

These items are those easily able to be removed from the property, for example carpets, smoke alarms, garbage bins, door closers, ovens, dishwashers, air conditioners, shower curtains and light fittings.

There are over 1,500 items identified as depreciable plant and equipment by the Australian Taxation Office. Unlike capital works, the age of these items is not a factor when calculating the depreciation deductions available for the owner. Each of these items is assigned an individual effective life and depreciation rate by which deductions will be calculated.

Depending on the value of the asset, some items may be able to be depreciated at a faster rate than others, using methods such as an immediate write-off (assets valued less than $300) or the

low-value pool (assets valued less than $1,000).

Is it beneficial to purchase a newer property to get more deductions?

While the above information helps investors to understand that all income producing property owners will benefit from claiming depreciation, a question often asked is ‘Is it better to purchase a new or an older property?’

As owners of new properties can claim capital works deductions for the full forty years, they are likely to receive more in deductions than the owners of older properties.

When a brand new property is constructed, the material used and the plant and equipment assets installed will have a higher starting value than those found in an older property. For this reason, newer property owners could receive higher deductions. However, owners of older properties still receive substantial deductions as they can claim the residual value of the building for up to forty years and as plant and equipment items are frequently replaced, often there may be very little difference in the depreciable value of assets between a new and an older property.

Old versus new, depreciation comparison

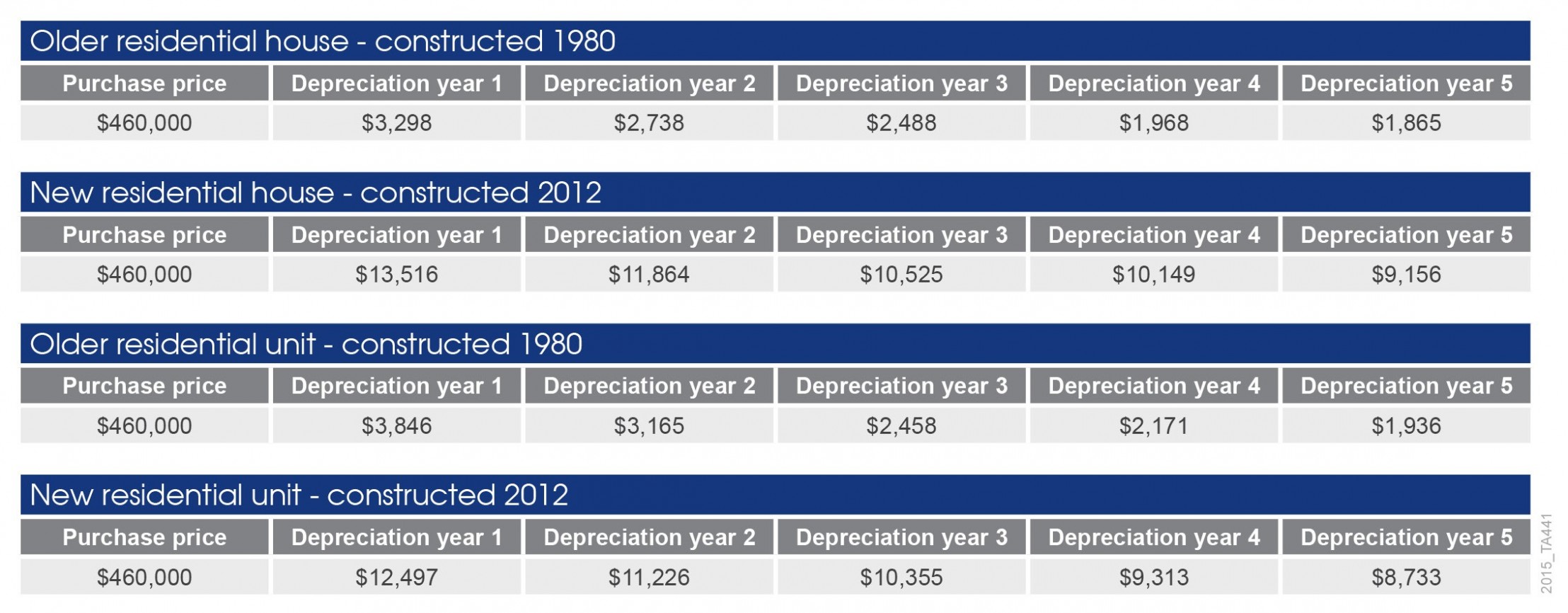

To examine the difference that a depreciation claim can made for the owners of new, old and recently constructed investment properties, let’s take a look at the deductions found for old and new houses and units all purchased at $460,000.

The depreciation deductions in this case study have been calculated using the diminishing value method. The depreciation found within properties of the same price and age can vary significantly depending on the property size and number of plant and equipment assets found in the property. Additional deductions may also apply if there has been any additional works or renovations completed.

As the table shows, the owner of a new residential house or unit will receive much higher deductions than the owner of an older residential house or unit constructed in 1980. In the first financial year the owner of the older residential house can claim $3,298 in depreciation while the owner of an older residential unit can claim $3,846. Over five years, the owners of these properties will still receive $12,357 and $13,576 in deductions respectively. These are substantial deductions that the owner of an older property should not miss out on.

No matter the age of the property, it is always best to seek advice from a specialist Quantity Surveyor on the depreciation deductions in any property. Quantity Surveyors can provide a free depreciation estimate on the deductions available before you proceed in requesting a depreciation schedule, so the very best advice any investor can take is to make the call to discuss their individual situation further.

Article provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Chief Executive Officer of BMT Tax Depreciation.

Bradley joined BMT in 1998 and as such he has substantial knowledge about property investment supported by expertise in property depreciation and the construction industry.

Bradley is a regular keynote speaker and presenter covering depreciation services on television, radio, at conferences and exhibitions Australia-wide. Please contact 1300 728 726 or visit www.bmtqs.com.au